Online marketplace scams cost Americans $12.5 billion in 2024—a 25% increase from the previous year. Facebook Marketplace alone sees 62% of its users targeted by scammers, and nearly half of all marketplace scam claims now originate on social media selling platforms.

The good news: most scams follow predictable patterns. By learning the warning signs and following proven safety practices, you can protect yourself while still selling successfully.

The Current Fraud Landscape

The FBI's Internet Crime Complaint Center received over 859,000 complaints in 2024, with reported losses totaling $16.6 billion. Non-payment and non-delivery scams specifically caused $785 million in losses—and these figures only represent reported incidents.

Marketplace scams have grown increasingly sophisticated. According to Barclays' 2025 Scams Bulletin, 49% of all scam claims now originate on online or social media marketplaces. The BBB reports that 87.5% of people targeted by online purchase scams lose money, making this one of the highest-risk fraud categories.

Police departments have documented a 340% increase in Facebook Marketplace-related crimes since 2021, including nearly 3,000 robbery or assault cases in 2024.

Eight Scam Categories Every Seller Must Recognize

1. Fake Payment Scams

The most common scam targeting sellers involves fraudulent payment confirmations. Scammers send doctored screenshots showing "payment sent" or "pending" via Zelle, Venmo, PayPal, or Cash App, then pressure sellers to ship immediately.

A newer, more sophisticated variant: scammers visit in person, show what appears to be a legitimate Zelle payment in the seller's bank account, take the item, and then have the funds reversed the next day through a "Deposit Adjustment" with no recourse available.

How to protect yourself:

- Always verify payments by logging directly into your bank app

- Never click links in payment confirmation emails

- Don't ship until funds actually appear in your account

- Wait 3-5 business days for checks to truly clear

2. Overpayment Scams

Buyers "accidentally" send more than the agreed price—often via fake check—then request you refund the "excess" via wire transfer, gift cards, or a peer-to-peer app.

The original payment inevitably bounces or reverses, leaving you without your item and out the refunded amount.

As Craigslist's official safety page states: "Distant person offers to send you a cashier's check or money order and then have you wire money: This is ALWAYS a scam."

Red flags:

- Any payment for more than you asked

- Requests to refund "overage" via different method

- Urgency to ship before payment fully clears

3. Shipping Address Manipulation

Package rerouting scams work by having buyers place legitimate-looking orders, then contact the shipping company directly to redirect packages to different addresses.

Sellers lose both item and money when buyers claim non-receipt or file chargebacks. PayPal Seller Protection becomes void since the item wasn't delivered to the original address.

How to protect yourself:

- Only ship to the address on the payment transaction

- Use signature confirmation for valuable items

- Add delivery instructions that prevent rerouting

4. Chargeback Fraud

Also called "friendly fraud," this has become a significant problem. Buyers purchase items, receive delivery confirmation, then file credit card chargebacks 30+ days later claiming the item was "not as described" or they "don't recognize the transaction."

Credit card companies typically side with buyers without requiring item returns. Gen Z accounts for over 60% of friendly fraud chargebacks, with more than 20% of survey respondents admitting to committing first-person fraud.

How to protect yourself:

- Document everything with photos and video

- Save all communication

- Ship with tracking and signature confirmation

- Describe item condition thoroughly in listings

5. Google Voice Verification Scam

This is now the #1 identity theft scam in America, accounting for 60% of all scams reported to the Identity Theft Resource Center.

How it works:

- Scammer contacts you as an interested buyer

- Asks for your phone number "to discuss the item"

- Requests you share a Google verification code "to prove you're real"

- Uses that code to create a Google Voice account linked to your number

With this, scammers can conduct further fraud while hiding their identity behind your phone number.

The rule: Never share verification codes with anyone, ever. No legitimate buyer needs a code from you.

6. Off-Platform Communication Requests

Scammers frequently ask to move conversations to text, email, or WhatsApp. This removes your audit trail and eliminates platform protections.

Why it matters:

- Platforms can't help resolve disputes they can't see

- You lose buyer/seller protection

- No record exists if you need to report fraud

The rule: Stay on-platform for all communication until the transaction is complete.

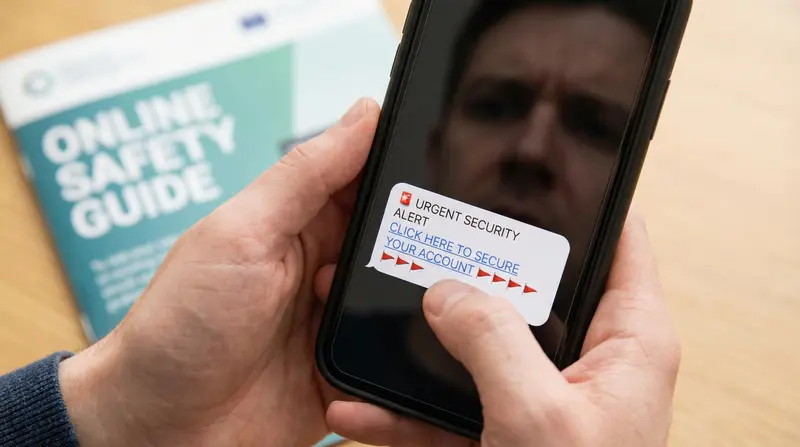

7. AI-Powered Phishing

AI-generated phishing attacks increased 26% in 2024. Attackers now create grammatically perfect, highly personalized messages without the spelling errors that traditionally signaled scams.

New tactics include:

- Fake AI marketplace assistants: Messages from "Facebook Marketplace Assistant" requesting verification

- QR code scams ("Quishing"): QR codes claiming to "verify" your seller account

- Tariff confusion scams: Claims that packages are "stuck in customs" requiring payment

How to protect yourself:

- Never click links in unexpected messages

- Go directly to platform websites rather than following links

- Be suspicious of any "verification" requests

8. In-Person Robbery

The most dangerous scam involves meeting strangers in isolated locations. Nearly 3,000 robbery or assault cases were linked to Facebook Marketplace in 2024.

How to protect yourself:

- Always meet at police safe exchange zones

- Bring someone with you

- Meet during daylight hours

- Trust your instincts—if something feels wrong, leave

Red Flags That Signal Potential Scams

Communication Warning Signs

Be immediately suspicious when buyers:

- Create artificial urgency ("I'm moving tomorrow," "Need it today")

- Request to communicate off-platform via text, email, or WhatsApp

- Send messages at unusual hours with copy-paste responses

- Refuse to meet in person for local sales

- Show no interest in item details or condition

Payment Red Flags

- Any offer above your asking price

- Requests for gift cards (92% of consumers correctly identify this as a scam)

- Wire transfers or cryptocurrency

- Peer-to-peer payment apps from strangers

- "Payment confirmation" emails with links to click

The FTC explicitly warns: "Treat Zelle and Venmo like handing someone cash—once you send the payment, it's usually gone for good."

Suspicious Buyer Profiles

Watch for:

- Newly created accounts with no activity

- No profile picture or obvious stock photos

- No buying/selling history

- Willingness to purchase without seeing the item

- No questions about condition or details

Platform-Specific Protections

eBay

eBay offers the strongest seller protections among major platforms:

- Top Rated Sellers with 30+ day return policies can deduct up to 50% from refunds for items returned damaged

- Abusive Buyer Policy removes negative feedback when buyers violate policies

- Money Back Guarantee covers most transactions

However, "Item Not As Described" chargebacks remain challenging to win. Document everything.

Poshmark and Mercari

Both platforms hold buyer payments until delivery confirmation:

- Mercari: Buyers have 72 hours post-delivery to report issues before funds release

- Poshmark: Allows 3 days for buyer review

Both offer prepaid shipping labels with protection—Mercari up to $200, Depop up to $300.

Facebook Marketplace

More limited protection than dedicated selling platforms:

- Use Meta Pay or Facebook Checkout exclusively for transaction protection

- The platform cannot mediate off-platform transactions

- Local cash sales remain common but offer no protection

Craigslist and OfferUp

Minimal built-in protection for these platforms:

- Cash-only transactions at police safe exchange zones are safest

- OfferUp's TruYou verification lets users verify identity with government ID

- Look for verified badges before agreeing to meet

Practical Safety Measures

Payment Hierarchy

For shipped items:

- Platform built-in payment systems (eBay, Poshmark, Mercari checkout)

- PayPal Goods & Services (never "Friends & Family")

For local sales:

- Cash only (inspect for counterfeits)

- Meet at police safe exchange zones

Never:

- Ship until payment clears your actual bank account

- Accept payments via gift cards, wire transfer, or cryptocurrency

- Trust email confirmations without verifying in your bank app

Safe Exchange Zones

Many police departments offer designated "Safe Exchange Zones" or "SafeTrade Stations"—well-lit, video-monitored parking spots available 24/7 at no cost.

These exist in hundreds of cities including Montgomery County (MD), Prince William County (VA), Naperville (IL), and Houston (TX).

As Prince William County police note: "If somebody is not willing to come to the Police Department to do an exchange, it is probably not a legitimate transaction."

Documentation

Save everything:

- Screenshots of all conversations

- Original listing with photos

- Payment confirmations

- Shipping receipts with tracking numbers

- Photographs of items showing condition and serial numbers

For valuable items, photograph and video-record the packing process. Keep records minimum 6 months after transaction completion.

Pro Tip: When creating listings, detailed descriptions and multiple photos don't just help you sell—they also protect you if a buyer claims an item wasn't as described. SellyGenie can help you generate thorough descriptions from your photos, creating documentation that serves double duty.

If You're Scammed: What to Do

Take Immediate Action

1. Report to the selling platform first:

- Facebook: Through Messenger conversation

- eBay: Resolution Center

- Mercari: Help Center

- Poshmark: Support

2. File reports with federal agencies:

- FTC at ReportFraud.ftc.gov (shared with 3,000+ law enforcement partners)

- FBI IC3 at ic3.gov (regardless of dollar amount)

3. Contact payment providers:

- Zelle: Contact your bank directly

- Venmo/Cash App: Use in-app support

- PayPal: Resolution Center

- Credit card: File chargeback within 60 days

Recovery Is Possible

The FBI's Financial Fraud Kill Chain achieved a 66% success rate in 2024, freezing $561 million in fraudulently obtained funds. But speed matters—contact financial institutions immediately after discovering fraud.

Report Even Small Losses

Reporting matters even for small amounts. Aggregate data helps law enforcement identify patterns and shut down scam operations. Your report could help prevent someone else from losing money.

Who's Most at Risk

Fraud impacts all ages differently:

- Adults 60+ reported $4.8 billion in losses in 2024—the highest of any age group

- Average loss for older adults: $83,000

- Younger adults (20-29) report losing money more frequently, but in smaller amounts

The BBB found that engagement duration correlates with losses: those who engaged with scammers for more than one day were significantly more likely to lose money. Walking away at the first red flag is your best protection.

Frequently Asked Questions

Is Zelle safe for selling items online?

Zelle is designed for payments between people who know and trust each other, not for marketplace transactions with strangers. There's no buyer or seller protection—once money is sent, it's usually gone for good. The FTC advises treating Zelle like cash. For online sales, use platform payment systems or PayPal Goods & Services instead.

How do I verify if a payment is real?

Never trust screenshots or email confirmations. Always log directly into your bank app or payment provider to verify funds are actually in your account. For checks, wait 3-5 business days for them to fully clear—banks may initially show the funds but can reverse them later if the check is fraudulent. Don't ship anything until payment is confirmed in your actual account.

Where can I meet buyers safely for local sales?

Use police safe exchange zones—designated parking spots at police stations that are well-lit, video-monitored, and available 24/7. Hundreds of police departments offer these at no cost. If no official zone exists nearby, meet in public places like bank lobbies, grocery store entrances, or busy parking lots during daylight hours. Never meet at your home or in isolated locations.

What should I do if a buyer asks for a verification code?

Never share any verification code with anyone. This is a scam—likely the Google Voice verification scam, which is now the #1 identity theft scam in America. No legitimate buyer needs a verification code from you. If someone asks, stop communication immediately and report the account to the platform.

Can I get my money back if I'm scammed?

Recovery is possible but depends on how you paid and how quickly you act. Report immediately to the platform, your bank, and federal agencies (FTC and FBI IC3). Credit card chargebacks must be filed within 60 days. The FBI's Financial Fraud Kill Chain recovered $561 million in 2024 with a 66% success rate—but speed matters. Bank wire transfers and gift cards are nearly impossible to recover.

Stay Safe While Selling

The marketplace fraud landscape continues evolving, but the fundamentals of protection remain straightforward:

- Verify all payments through your actual bank account before shipping

- Conduct local transactions at police safe exchange zones using cash only

- Stay on-platform for all communications

- Never share verification codes with anyone

- Document every transaction thoroughly

- Walk away at the first red flag

With vigilance and proper use of platform protections, you can sell safely online. The scammers are looking for easy targets—don't be one.

Ready to Create Secure, Professional Listings?

Detailed listings with thorough descriptions and multiple photos don't just help you sell faster—they also protect you if disputes arise. SellyGenie generates professional descriptions from your product photos, creating the documentation you need for both sales success and seller protection.